All Categories

Featured

Table of Contents

The performance of those funds will certainly determine just how the account expands and just how big a payment the customer will eventually obtain.

If an annuity buyer is married, they can pick an annuity that will continue to pay earnings to their spouse should they die. Annuities' payments can be either instant or postponed. The standard question you need to consider is whether you want normal income currently or at some future day.

A credit allows the cash in the account more time to grow. And similar to a 401(k) or an private retired life account (INDIVIDUAL RETIREMENT ACCOUNT), the annuity remains to gather revenues tax-free up until the cash is taken out. Gradually, that could develop right into a significant amount and result in larger payments.

With an immediate annuity, the payments begin as quickly as the purchaser makes a lump-sum repayment to the insurance policy business. There are a few other vital decisions to make in getting an annuity, depending upon your scenarios. These include the following: Purchasers can organize for repayments for 10 or 15 years, or for the remainder of their life.

Highlighting Variable Vs Fixed Annuity A Comprehensive Guide to Investment Choices Defining What Is A Variable Annuity Vs A Fixed Annuity Features of Fixed Interest Annuity Vs Variable Investment Annuity Why Variable Annuities Vs Fixed Annuities Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Risks of Fixed Interest Annuity Vs Variable Investment Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Indexed Annuity Vs Fixed Annuity A Beginner’s Guide to Fixed Indexed Annuity Vs Market-variable Annuity A Closer Look at How to Build a Retirement Plan

That may make good sense, for instance, if you need a revenue boost while repaying the final years of your mortgage. If you're married, you can choose an annuity that pays for the rest of your life or for the rest of your partner's life, whichever is much longer. The latter is usually referred to as a joint and survivor annuity.

The option in between deferred and immediate annuity payments depends greatly on one's cost savings and future incomes goals. Immediate payouts can be beneficial if you are currently retired and you require a resource of earnings to cover day-to-day costs. Immediate payments can begin as quickly as one month into the purchase of an annuity.

Individuals typically acquire annuities to have a retirement revenue or to develop financial savings for an additional function. You can buy an annuity from a licensed life insurance coverage agent, insurance policy company, economic coordinator, or broker. You must talk with a monetary advisor concerning your requirements and goals before you get an annuity.

The distinction between the 2 is when annuity settlements start. You don't have to pay taxes on your profits, or contributions if your annuity is a specific retirement account (INDIVIDUAL RETIREMENT ACCOUNT), till you withdraw the profits.

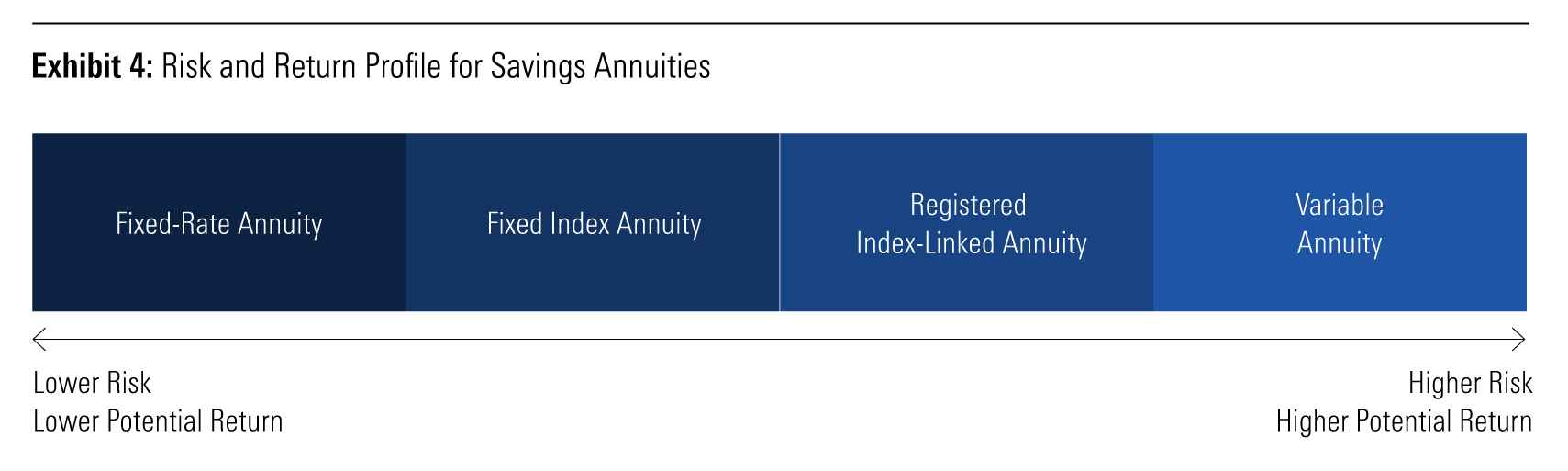

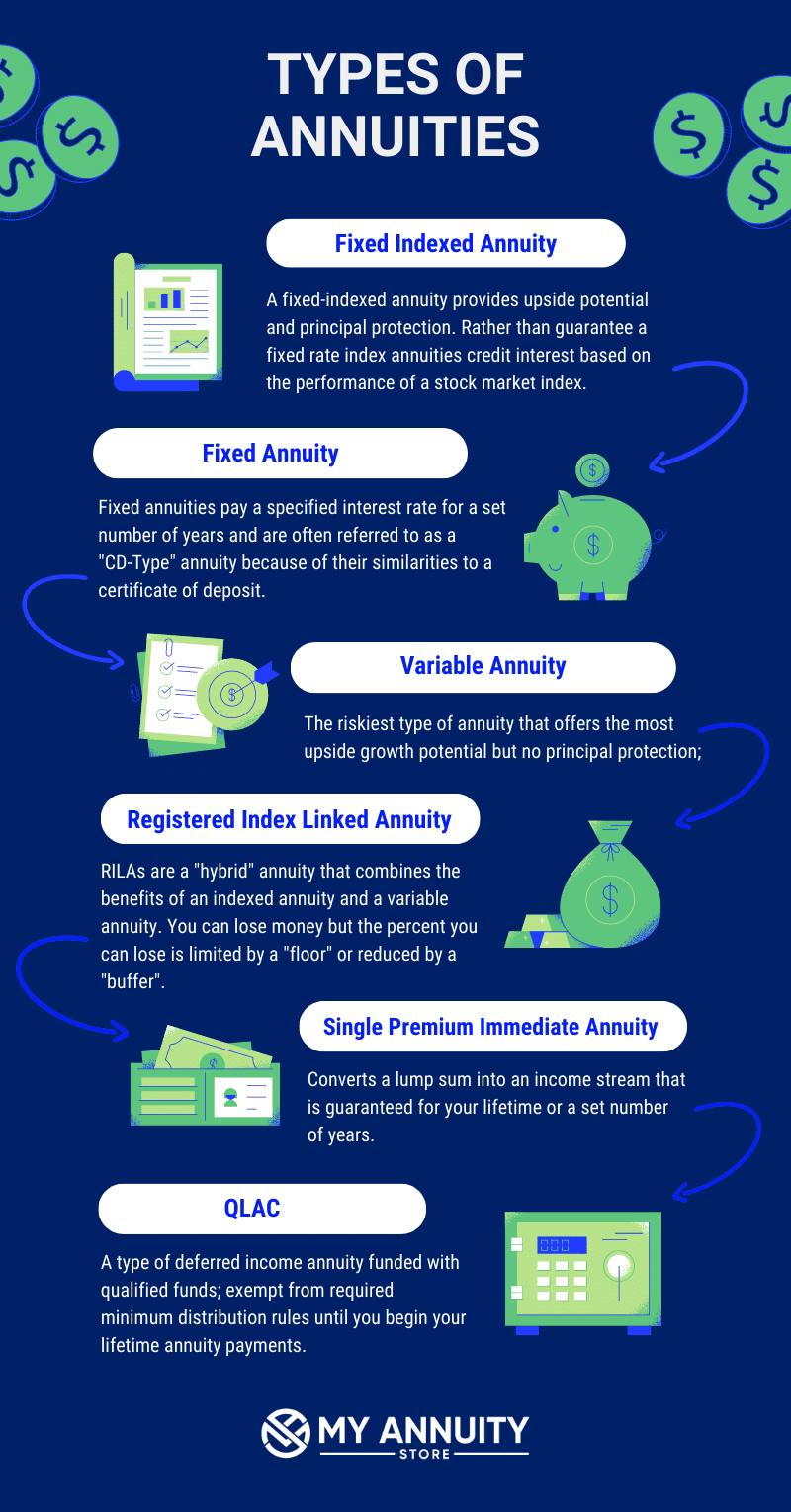

Deferred and prompt annuities supply numerous choices you can select from. The options supply various levels of potential danger and return: are assured to gain a minimal rates of interest. They are the most affordable financial risk but give reduced returns. gain a higher rates of interest, yet there isn't an assured minimum rate of interest.

Variable annuities are greater threat because there's an opportunity you could shed some or all of your money. Set annuities aren't as high-risk as variable annuities because the investment threat is with the insurance business, not you.

Breaking Down Annuities Fixed Vs Variable A Closer Look at Variable Annuities Vs Fixed Annuities Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why Immediate Fixed Annuity Vs Variable Annuity Is Worth Considering How to Compare Different Investment Plans: Simplified Key Differences Between Fixed Vs Variable Annuities Understanding the Rewards of Fixed Index Annuity Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Deferred Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Fixed Indexed Annuity Vs Market-variable Annuity

Set annuities assure a minimum interest price, generally between 1% and 3%. The company could pay a greater passion rate than the assured passion rate.

Index-linked annuities show gains or losses based on returns in indexes. Index-linked annuities are more complicated than repaired deferred annuities. It is very important that you recognize the functions of the annuity you're taking into consideration and what they imply. The 2 legal features that influence the amount of interest credited to an index-linked annuity the most are the indexing technique and the involvement rate.

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why Fixed Annuity Vs Variable Annuity Matters for Retirement Planning Fixed Vs Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Retirement Income Fixed Vs Variable Annuity A Beginner’s Guide to Retirement Income Fixed Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

Each relies upon the index term, which is when the firm computes the passion and credit histories it to your annuity. The establishes just how much of the increase in the index will be utilized to calculate the index-linked interest. Other essential functions of indexed annuities consist of: Some annuities cover the index-linked rate of interest.

The flooring is the minimum index-linked rate of interest you will earn. Not all annuities have a flooring. All repaired annuities have a minimum guaranteed worth. Some companies make use of the average of an index's worth as opposed to the value of the index on a specified date. The index averaging might happen any kind of time during the term of the annuity.

Exploring Variable Annuity Vs Fixed Annuity Key Insights on Variable Vs Fixed Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Annuities Fixed Vs Variable Can Impact Your Future Fixed Interest Annuity Vs Variable Investment Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Fixed Vs Variable Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Annuities Fixed Vs Variable A Closer Look at How to Build a Retirement Plan

The index-linked interest is added to your original costs quantity however doesn't substance during the term. Various other annuities pay substance passion during a term. Compound rate of interest is rate of interest gained on the money you saved and the interest you make. This indicates that interest currently attributed likewise gains passion. In either case, the rate of interest made in one term is typically worsened in the following.

This portion might be utilized rather than or in addition to an engagement rate. If you get all your cash before the end of the term, some annuities will not attribute the index-linked passion. Some annuities may credit only component of the interest. The percent vested typically boosts as the term nears the end and is constantly 100% at the end of the term.

This is because you bear the financial investment risk rather than the insurance provider. Your agent or economic advisor can aid you decide whether a variable annuity is appropriate for you. The Securities and Exchange Compensation classifies variable annuities as safeties because the efficiency is stemmed from supplies, bonds, and other investments.

An annuity agreement has two stages: a buildup phase and a payment stage. You have numerous options on how you add to an annuity, depending on the annuity you get: enable you to select the time and quantity of the repayment.

The Internal Income Solution (INTERNAL REVENUE SERVICE) controls the taxation of annuities. If you withdraw your incomes prior to age 59, you will possibly have to pay a 10% very early withdrawal charge in enhancement to the tax obligations you owe on the passion gained.

After the buildup stage ends, an annuity enters its payout stage. This is sometimes called the annuitization phase. There are numerous alternatives for getting repayments from your annuity: Your company pays you a taken care of quantity for the time stated in the contract. The firm makes payments to you for as lengthy as you live, but there are not any type of repayments to your successors after you pass away.

Decoding Variable Vs Fixed Annuities A Closer Look at Fixed Index Annuity Vs Variable Annuity Defining Variable Vs Fixed Annuity Advantages and Disadvantages of Variable Annuities Vs Fixed Annuities Why Choosing the Right Financial Strategy Is a Smart Choice Annuity Fixed Vs Variable: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Tax Benefits Of Fixed Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Annuities Variable Vs Fixed Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Lots of annuities bill a charge if you withdraw money before the payment phase. This fine, called a surrender cost, is usually highest in the very early years of the annuity. The cost is frequently a percent of the withdrawn money, and typically starts at about 10% and goes down yearly until the surrender duration is over.

Annuities have various other charges called tons or compensations. In some cases, these costs can be as high as 2% of an annuity's worth. Consist of these costs when approximating the price to acquire an annuity and the quantity you will certainly earn from it. If an annuity is a great choice for you, utilize these ideas to assist you store: Costs and advantages vary from business to business, so talk with greater than one company and compare.

Variable annuities have the capacity for greater earnings, however there's even more threat that you'll shed cash. Be careful about placing all your possessions right into an annuity.

Annuities sold in Texas has to have a 20-day free-look duration. Substitute annuities have a 30-day free-look period.

Table of Contents

Latest Posts

Breaking Down Fixed Index Annuity Vs Variable Annuity Key Insights on Your Financial Future What Is Fixed Index Annuity Vs Variable Annuity? Pros and Cons of Deferred Annuity Vs Variable Annuity Why F

Exploring Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Variable Vs Fixed Annuities Defining the Right Financial Strategy Benefits of Fixed Index Annuity Vs Variable Annuiti

Highlighting the Key Features of Long-Term Investments Key Insights on Your Financial Future What Is Retirement Income Fixed Vs Variable Annuity? Pros and Cons of Indexed Annuity Vs Fixed Annuity Why

More

Latest Posts