All Categories

Featured

Table of Contents

Note, nonetheless, that this does not claim anything concerning changing for inflation. On the plus side, even if you assume your choice would certainly be to invest in the stock market for those seven years, which you 'd get a 10 percent yearly return (which is far from particular, specifically in the coming decade), this $8208 a year would certainly be greater than 4 percent of the resulting small stock value.

Instance of a single-premium deferred annuity (with a 25-year deferment), with four payment choices. Courtesy Charles Schwab. The month-to-month payment right here is highest for the "joint-life-only" alternative, at $1258 (164 percent greater than with the instant annuity). The "joint-life-with-cash-refund" alternative pays out just $7/month less, and assurances at the very least $100,000 will be paid out.

The means you get the annuity will identify the response to that question. If you purchase an annuity with pre-tax bucks, your premium minimizes your taxable income for that year. According to , getting an annuity inside a Roth strategy results in tax-free payments.

What is the most popular Senior Annuities plan in 2024?

The expert's first action was to create a comprehensive financial strategy for you, and afterwards discuss (a) exactly how the proposed annuity matches your overall plan, (b) what choices s/he considered, and (c) how such options would or would not have caused reduced or greater payment for the advisor, and (d) why the annuity is the superior selection for you. - Tax-efficient annuities

Of course, an advisor might attempt pushing annuities also if they're not the most effective fit for your scenario and objectives. The factor could be as benign as it is the only product they market, so they drop victim to the typical, "If all you have in your tool kit is a hammer, quite quickly every little thing begins resembling a nail." While the expert in this circumstance might not be dishonest, it boosts the danger that an annuity is a poor option for you.

What are the top Fixed Indexed Annuities providers in my area?

Because annuities often pay the representative marketing them a lot higher commissions than what s/he would receive for spending your cash in common funds - Fixed indexed annuities, not to mention the absolutely no payments s/he would certainly receive if you purchase no-load common funds, there is a big incentive for agents to push annuities, and the a lot more complex the much better ()

A deceitful consultant recommends rolling that amount right into brand-new "better" funds that simply occur to carry a 4 percent sales load. Consent to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't likely to perform better (unless you picked a lot more badly to start with). In the very same instance, the expert can steer you to acquire a complex annuity with that said $500,000, one that pays him or her an 8 percent commission.

The consultant hasn't figured out exactly how annuity repayments will be taxed. The expert hasn't disclosed his/her settlement and/or the costs you'll be charged and/or hasn't revealed you the influence of those on your eventual settlements, and/or the settlement and/or fees are unacceptably high.

Your family members history and existing health and wellness indicate a lower-than-average life span (Annuity contracts). Current rates of interest, and hence forecasted settlements, are historically reduced. Also if an annuity is ideal for you, do your due persistance in contrasting annuities sold by brokers vs. no-load ones marketed by the releasing business. The latter might require you to do even more of your own research study, or use a fee-based economic consultant that may receive payment for sending you to the annuity provider, however might not be paid a greater compensation than for various other financial investment choices.

Retirement Annuities

The stream of month-to-month repayments from Social Security is similar to those of a postponed annuity. Given that annuities are voluntary, the people getting them normally self-select as having a longer-than-average life expectations.

Social Security advantages are completely indexed to the CPI, while annuities either have no rising cost of living security or at most provide a set portion annual increase that may or might not compensate for rising cost of living completely. This sort of rider, as with anything else that raises the insurance provider's danger, needs you to pay even more for the annuity, or approve reduced payments.

How can an Annuity Riders protect my retirement?

Please note: This short article is intended for informational functions just, and must not be thought about economic advice. You must consult a monetary specialist before making any type of major financial decisions.

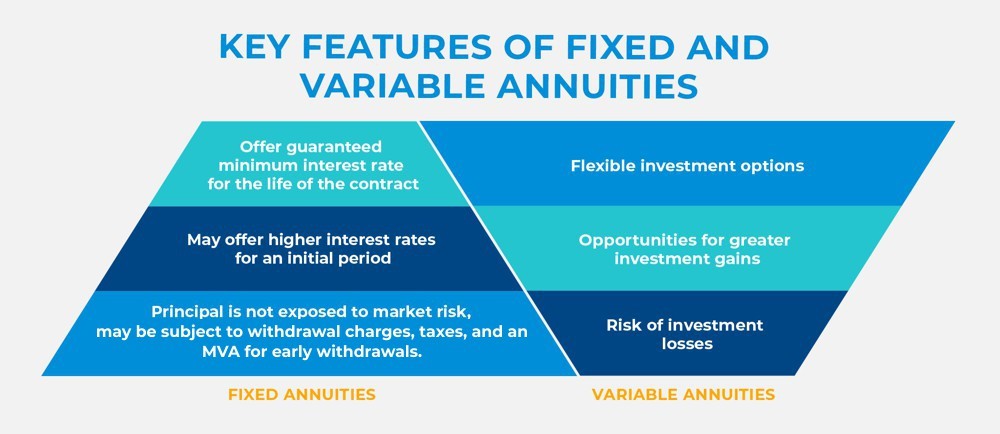

Given that annuities are meant for retired life, tax obligations and charges may use. Principal Protection of Fixed Annuities. Never ever shed principal due to market performance as taken care of annuities are not purchased the marketplace. Also during market declines, your money will not be affected and you will not lose money. Diverse Financial Investment Options.

Immediate annuities. Used by those who desire dependable earnings quickly (or within one year of acquisition). With it, you can tailor earnings to fit your requirements and create income that lasts permanently. Deferred annuities: For those that intend to expand their money in time, but want to delay access to the money until retirement years.

How do I cancel my Fixed Annuities?

Variable annuities: Gives higher possibility for development by spending your money in financial investment options you pick and the capacity to rebalance your portfolio based on your choices and in such a way that straightens with changing financial goals. With taken care of annuities, the company invests the funds and provides a passion price to the customer.

When a fatality case takes place with an annuity, it is vital to have actually a called beneficiary in the agreement. Various options exist for annuity fatality benefits, depending upon the agreement and insurer. Selecting a reimbursement or "duration specific" option in your annuity provides a death advantage if you die early.

Is there a budget-friendly Retirement Income From Annuities option?

Calling a recipient besides the estate can assist this process go more smoothly, and can help make sure that the earnings most likely to whoever the individual desired the cash to visit instead than undergoing probate. When existing, a survivor benefit is instantly included with your agreement. Depending on the type of annuity you buy, you may be able to include improved fatality benefits and attributes, but there can be additional expenses or charges related to these attachments.

Table of Contents

Latest Posts

Breaking Down Fixed Index Annuity Vs Variable Annuity Key Insights on Your Financial Future What Is Fixed Index Annuity Vs Variable Annuity? Pros and Cons of Deferred Annuity Vs Variable Annuity Why F

Exploring Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Variable Vs Fixed Annuities Defining the Right Financial Strategy Benefits of Fixed Index Annuity Vs Variable Annuiti

Highlighting the Key Features of Long-Term Investments Key Insights on Your Financial Future What Is Retirement Income Fixed Vs Variable Annuity? Pros and Cons of Indexed Annuity Vs Fixed Annuity Why

More

Latest Posts