All Categories

Featured

Table of Contents

Many annuities bill a penalty if you take out cash prior to the payout phase. This penalty, called a surrender charge, is normally highest in the early years of the annuity - Guaranteed income annuities. The charge is usually a percentage of the taken out money, and normally starts at about 10% and drops every year until the surrender period mores than

Annuities have actually various other charges called tons or commissions. Often, these charges can be as long as 2% of an annuity's value. Consist of these charges when approximating the cost to acquire an annuity and the amount you will certainly gain from it. If an annuity is an excellent option for you, use these suggestions to help you store: Costs and advantages vary from firm to company, so talk to even more than one firm and compare.

How do I get started with an Fixed Vs Variable Annuities?

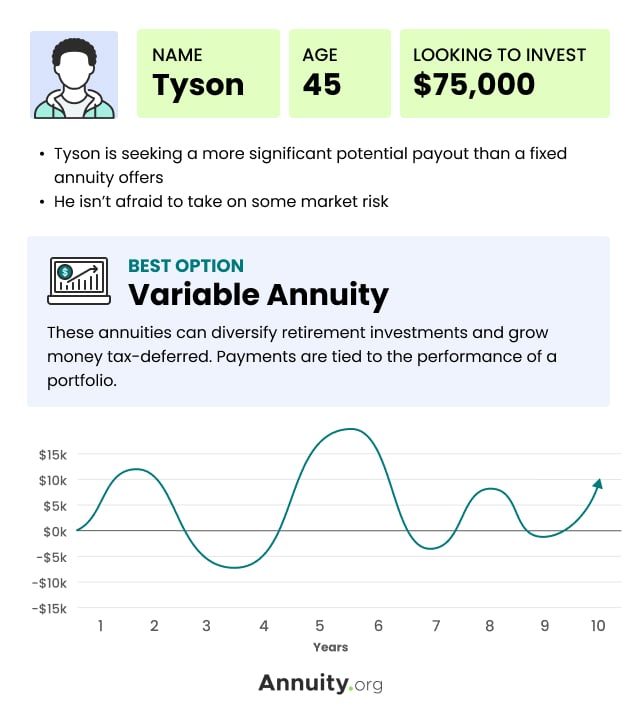

Variable annuities have the possibility for greater incomes, however there's more threat that you'll lose money. Be cautious about placing all your properties right into an annuity. Representatives and firms must have a Texas insurance policy certificate to legitimately offer annuities in the state. The issue index is an indicator of a business's client service record.

Take time to decide. Annuities sold in Texas needs to have a 20-day free-look duration. Replacement annuities have a 30-day free-look duration. Throughout the free-look period, you may cancel the contract and get a full refund. A financial advisor can aid you evaluate the annuity and contrast it to various other financial investments.

Annuity Accumulation Phase

The quantity of any type of surrender costs. Whether you'll lose any kind of bonus passion or features if you quit your annuity. The guaranteed rate of interest of both your annuity and the one you're considering changing it with. Just how much cash you'll need to begin the brand-new annuity. The loads or compensations for the new annuity.

See to it any agent or business you're taking into consideration purchasing from is licensed and economically steady (Annuity interest rates). To confirm the Texas license status of a representative or company, call our Customer service at 800-252-3439. You can also utilize the Firm Lookup function to learn a company's financial rating from an independent ranking organization

Morningstar has no obligation for the compilation or upkeep of the Index or its performance, and no liability to any person for its use. The Morningstar name and logo are registered marks of Morningstar. Morningstar does not guarantee the accuracy, efficiency or timeliness of the United States Returns Growth Index or any type of data included in it and expressly disclaims any type of warranties linked with it.

In Addition, Bankers Life and Casualty Business as provider of the Bankers Annuity may for itself implement transaction(s) with Barclays in or connecting to the Index about the Bankers Annuity - Annuity accumulation phase. Buyers buy the Bankers Annuity from Bankers Life and Casualty Business and buyers neither get any type of rate of interest in the Index neither enter right into any kind of connection of any kind of kind whatsoever with Barclays upon making an acquisition of the Bankers Annuity

Can I get an Flexible Premium Annuities online?

Barclays shall not be accountable by any means to the purchasers or to other third parties in regard of the use or precision of the Index or any information consisted of therein. **The premium reward rate suitable to each premium deposit may differ however will go to least 1 - Annuity payout options.00%. Qualified costs will receive a bonus offer

Withdrawals from the annuity over of the totally free partial withdrawal, or other distributions, may result in a portion of the premium benefit that has actually not vested being surrendered. 2 Each costs will certainly have its very own premium benefit and withdrawal cost period and withdrawal costs. Costs deposited on or after the anniversary following the Annuitant's 85th birthday celebration will certainly not receive a premium incentive and will certainly not be subject to withdrawal charges.

A.M. Best: A (Exceptional). This score is their analysis of our loved one monetary toughness and capability to fulfill legal commitments. This score is the 3rd highest of sixteen. For the most recent ranking, go to . This is an annuity insurance policy solicitation. An insurance agent/producer might call you. Policy form numbers: LA-02P( 13 ), ICC14-LA-03D, LA-06T( 13 ), LA-07G, LA-08N( 13 ), LA-69A. ICC22B4002, B4002 In New york city, plan BLNY-LA-06T( 16 ).

They are not backed by the broker-dealer and/or insurance coverage agency marketing the policy, or any type of associates of those entities other than the releasing business affiliates, and none makes any type of representations or assurances pertaining to the claims-paying capability of the company. These products and its features undergo state schedule and might differ by state.

Can I get an Fixed Annuities online?

and have actually been licensed for use by Bankers Life and Casualty Firm. Bankers Life annuities are not sponsored, backed, offered or promoted by Standard & Poor's and Requirement & Poor's makes no depiction pertaining to the sensibility of acquiring any kind of annuity. Annuities are products of the insurance coverage sector and are not guaranteed by the FDIC or any other federal government company.

Does not make up financial investment guidance or a suggestion. Bankers Life is the marketing brand of Bankers Life and Casualty Business, Medicare Supplement insurance policy policies offered by Washington National Insurance Company and pick plans marketed in New york city by Bankers Conseco Life Insurance Policy Firm (BCLIC). BCLIC is accredited to market insurance policy in New york city.

It's talking to your moms and dads concerning annuities and monetary guidance for senior citizens, and it's kind of entailing that hard conversation as they cognitively begin shedding it a little bit. It's a difficult subject, yet we're going to have a little bit of enjoyable because I can't not have enjoyable.

My papa passed away a couple of years earlier, and my mama is doing quite well. We established up her expense paying so that all the costs we can pay are done digitally, and she doesn't have to create checks.

What are the top Annuity Income providers in my area?

I set my mother up on Uber. I truly do not want my mommy driving. Of program, she does not believe she can manage it.

But when we speak about culture's aging, this is a fascinating time and a wonderful story, and this is what drove me to do this blog site. A client of mine contacted and said the following, and it was a hammer shot to me because I didn't truly believe concerning it until he claimed it.

And I stated to him, I claimed, "Just stop - Flexible premium annuities. And I applauded him for taking that positive action because that's difficult.

Why is an Annuity Income important for my financial security?

We're all mosting likely to have to do that ultimately unless our Lear jet strikes the hill, right? But the factor is, he was doing it proactively for himself. And perhaps you're assuming that around. Maybe that's what you're thinking: hello, we're standing up in years, and our moms and dads or my parents or whoever shed some cognitive capability to make those choices.

Table of Contents

Latest Posts

Breaking Down Fixed Index Annuity Vs Variable Annuity Key Insights on Your Financial Future What Is Fixed Index Annuity Vs Variable Annuity? Pros and Cons of Deferred Annuity Vs Variable Annuity Why F

Exploring Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Variable Vs Fixed Annuities Defining the Right Financial Strategy Benefits of Fixed Index Annuity Vs Variable Annuiti

Highlighting the Key Features of Long-Term Investments Key Insights on Your Financial Future What Is Retirement Income Fixed Vs Variable Annuity? Pros and Cons of Indexed Annuity Vs Fixed Annuity Why

More

Latest Posts